If you’ve been considering working with a registered dietitian nutritionist but were unsure if insurance would cover the cost, you’re not alone. The good news is that many health insurances do cover dietitian visits, but the process of finding out can be confusing. In this blog post, we’ll walk you through how to determine if your health insurance plan covers registered dietitian nutritionists and what to do if it doesn’t. We hope this information helps make working with a registered dietitian nutritionist more accessible for you!

As a registered dietitian myself, I find that many people don’t realize how much their health insurance can cover when it comes to working with registered dietitian nutritionists.

In some cases, insurance can cover unlimited visits with a registered dietitian nutritionist.

We’ll start by diving into the details about different types of health insurance available. Take out your health insurance card and a notepad to get started.

Table of Contents

Health Insurance 101

Let’s first start by diving into the different types of health insurance companies.

They can also be referred to as health insurance payers.

Health insurance payers

There are several major types of health insurance payer categories. In this section, we’ll dive into the different options.

Private Pay

Private pay insurance is an insurance company that is not federally run.

They are private companies.

The most common examples of private pay insurance in the United States are;

- UnitedHealth

- Kaiser

- Anthem

- Humana

- Blue Cross Blue Shield (BCBS)

- CVS

Private pay insurance is usually provided through employers, marketplace plans such as ObamaCare, or health insurance agents.

The specific private pay insurance providers available also vary based on each state.

Medicare

Medicare is a federal health insurance plan.

Insurance coverage for those over the age of 65, certain disabilities, and those with end-stage kidney failure on dialysis.

If you are under 65 years old but are on dialysis, you qualify for Medicare health insurance.

Some people are automatically enrolled in Medicare once they turn 65. Many are required to apply for Medicare coverage once they qualify.

Does Medicare cover nutritionists?

Yes, Medicare does cover visits with a registered dietitian nutritionist.

Nutrition counseling, known as medical nutrition therapy, is covered for Medicare patients with kidney disease and/or diabetes.

Medicare & End Stage Kidney Failure on Dialysis

This is most often the case for those on dialysis. However, a dialysis patient can speak with their dialysis clinic’s social worker or insurance coordinator to help with enrollment.

Medicare covers 80% of dialysis costs.

You must have Medicare Part B to get outpatient (in a normal dialysis clinic) or home dialysis.

It is highly recommended those on dialysis have two health insurance plans to cover dialysis costs.

Many people on dialysis also choose to have Part D included, which covers many prescription drugs. (The average number of medications a person on dialysis takes is 19 pills per day.)

Speak with your dialysis clinic’s social worker or insurance coordinator if you are on dialysis and not aware of your Medicare health insurance situation.

Medicare Advantage

Medicare Advantage plans are provided by private payer companies.

They are provided by private companies. However, Medicare Advantage plans follow the Medicare guidelines for coverage, not the private payer guidelines.

These plans include part A, part B, and many times part D (drug coverage) of Medicare plans.

Do Medicare Advantage Plans Cover Nutritionists?

Yes, because Medicare Advantage plans follow Medicare guidelines, they also cover medical nutrition therapy.

Medicare allows for three hours of medical nutrition therapy with a registered dietitian and two hours every year after.

You may be able to qualify for additional hours if your doctor says you need them.

Medicare nutrition coverage for dialysis

If you are on dialysis in the United States, your insurance covers your dietitian visits at your dialysis clinic.

Dialysis dietitians are very busy and usually see a lot of patients, so be sure to communicate with your dietitian when you have a question. We love when our patients want to see us!

Medicaid

Medicaid is a state-run health insurance program offered to low-income individuals.

The Children’s Health Insurance Program (CHIP) falls under Medicaid and offers health insurance for children under the age of 18.

Those on dialysis may also qualify for Medicaid plans in their state.

Again, it’s best to speak with your social worker in the dialysis center to determine what insurance coverage you qualify for.

Does Medicaid cover nutritionists?

Since Medicaid will vary by state, it may or may not be covered.

Tricare

Tricare is the health care program for uniformed service members, their families, and retirees from service.

It provides health coverage similar to private pay or Medicare plans and covers medical treatments and prescriptions.

There are several types of plans within Tricare for eligible members to choose from.

Does Tricare cover nutritionists?

Tricare may cover visits with a registered dietitian nutritionist. It is likely you will need a referral from your primary provider to see one.

However, ask your Tricare representative for details.

Health Insurance Plans

Now that we have covered the types of insurance provider options, we can dive into the plans that may be available within these providers.

Health Maintenance Organization

A health maintenance organization (HMO) is one of the most common plans.

It does not provide as much flexibility as a Preferred Provider Organization plan (PPO). More on PPOs below.

With an HMO, it’s important to have updated provider directory information to know exactly which providers you can see with your health insurance.

Be prepared to pay the full bill if you choose to see a provider that does not take your insurance.

Thankfully, with the No Surprises Act, providers must provide a Good Faith Estimate up to 3 days prior to a service.

Preferred Provider Organization

A preferred provider organization (PPO) plan allows more ability to see providers outside of your plan.

You may need to pay a certain amount of the bill if you choose to see a doctor out of the health insurance network.

With a PPO, you generally won’t need a referral from your primary care physician. However, you may pay more out of pocket.

Point of Service

With a point of service (POS) plan, you must have a referral from your primary doctor.

Even so, you’re still likely to have access to a greater variety of providers compared to an HMO plan.

Exclusive Provider Organization

An Exclusive Provider Organization (EPO) is a health plan that includes a local provider directory.

Expect to pay out of pocket if you want to see a provider that is not included in your provider directory. Emergencies are excluded in this.

An EPO plan generally has a premium and higher deductible.

High Deductible Health Plan

A High Deductible Health Plan (HDHP) is a health insurance plan that requires a larger deductible to be paid before insurance coverage starts.

For 2024, the IRS defines an HDHP as a plan with an annual deductible that is at least $1,600 for self-only coverage or $3,200 for family coverage.

The annual out-of-pocket expenses, including deductibles, co-payments, and other amounts, (but not premiums), do not exceed $8,050 for self-only coverage or $16,100 for family coverage as of 2024.

Health Insurance Key Terms

Next, we’ll cover some of the more common terms related to health insurance. The goal here is to help you feel more confident in words that you may hear at your health appointments.

Premium

The premium is what you pay to have an active health insurance plan.

This payment can be monthly, quarterly, or annually.

If you receive health insurance through your employer, they may pay some or all of this piece of your health insurance premium.

You can find details on your paystub or by speaking with your human resources department.

Deductible

Your deductible is the amount you will pay before your health insurance “kicks in” to cover the rest.

The deductible can be a few hundred to several thousand depending on your health insurance plan.

Once you have spent the deductible amount, you’ll only be responsible for the copay.

For example, if you have a deductible of $1,500, you’ll pay for certain aspects of your care until the total spent is $1,500 before your health insurance comes in to cover costs.

Many plans will cover health expenses like preventive visits before you run through your deductible.

Plans with lower premiums will likely have higher deductibles.

It’s up to you to decide if you want to spend the money ahead with a plan that will cover more later, or spend less now and pay more at the doctor’s office.

Copay or copayment

The copay is your amount due at a service after you have paid your deductible. Copays can vary depending on the type of service provided.

For example, your primary doctor may have a lower copay than a specialist’s copay.

The copay is a fixed amount you can often find listed on your health insurance card.

Copays are required regardless of how much you have put towards your deductible. In many cases, your copay can be counted towards your deductible.

Similar to the deductible, plans with lower premiums may have higher copays.

Co-Insurance

Co-insurance is the amount you will pay after meeting your deductible. It’s essentially the part of the medical expense that you are responsible for.

For example, your plan may have an 80/20 coinsurance plan. Therefore, your health insurance payer covers 80% of the bill and you pay 20% of the bill.

This is different from your co-pay as it is a percentage of the expense rather than a fixed amount.

Out-of-Pocket Limit

Also called the out-of-pocket maximum, this is the most you will pay towards your costs.

This includes your deductible, copays and co-insurance.

Allowed Amount

This is the maximum amount a health insurance plan will pay for a covered health care service.

If your provider charges more than this amount, you may have to pay the difference.

Health Savings Account

A health savings account (HSA) is a type of savings account that lets you set aside before taxed income to a savings account used to pay medical expenses.

They are offered in High Deductible Health Plans. You can also find HSAs through banks.

Health Savings Accounts can be an extremely valuable asset as it saves on taxes. Additionally, you have an account that is automatically set aside for you to use on your health.

For example, your HSA can be used towards health expenses including copays, deductibles, and even purchases like contact lenses or health programs (like the Plant-Powered Kidneys course!).

HSAs cannot be used towards your health insurance premiums.

You can contribute towards your HSA every year. For 2024, a self-only plan will allow up to $4,150.

A person with family coverage may contribute up to $8,300 for the year.

If you are over the age of 55, you can contribute an additional $1,000 per year.

Flexible Savings Account

A flexible savings account is similar to an HSA in some ways. An FSA is through your employer and still allows you to use pre-tax dollars towards out-of-pocket expenses.

With an FSA, though, you must use all funds before the plan year ends.

P.S.- Our Plant-Powered Kidneys Course and private work with dietitians both accept HSAs and FSAs!

Superbill

A superbill is a receipt of a medical service provided after you pay out-of-pocket.

It will include the codes required by the health insurance company. It will be up to the insurance company to determine any reimbursement.

Superbills are provided after the rendered service.

If you are seeing a specialist, such as a dietitian nutritionist, your health insurance may require you to obtain details from your primary physician. This is similar to getting a referral.

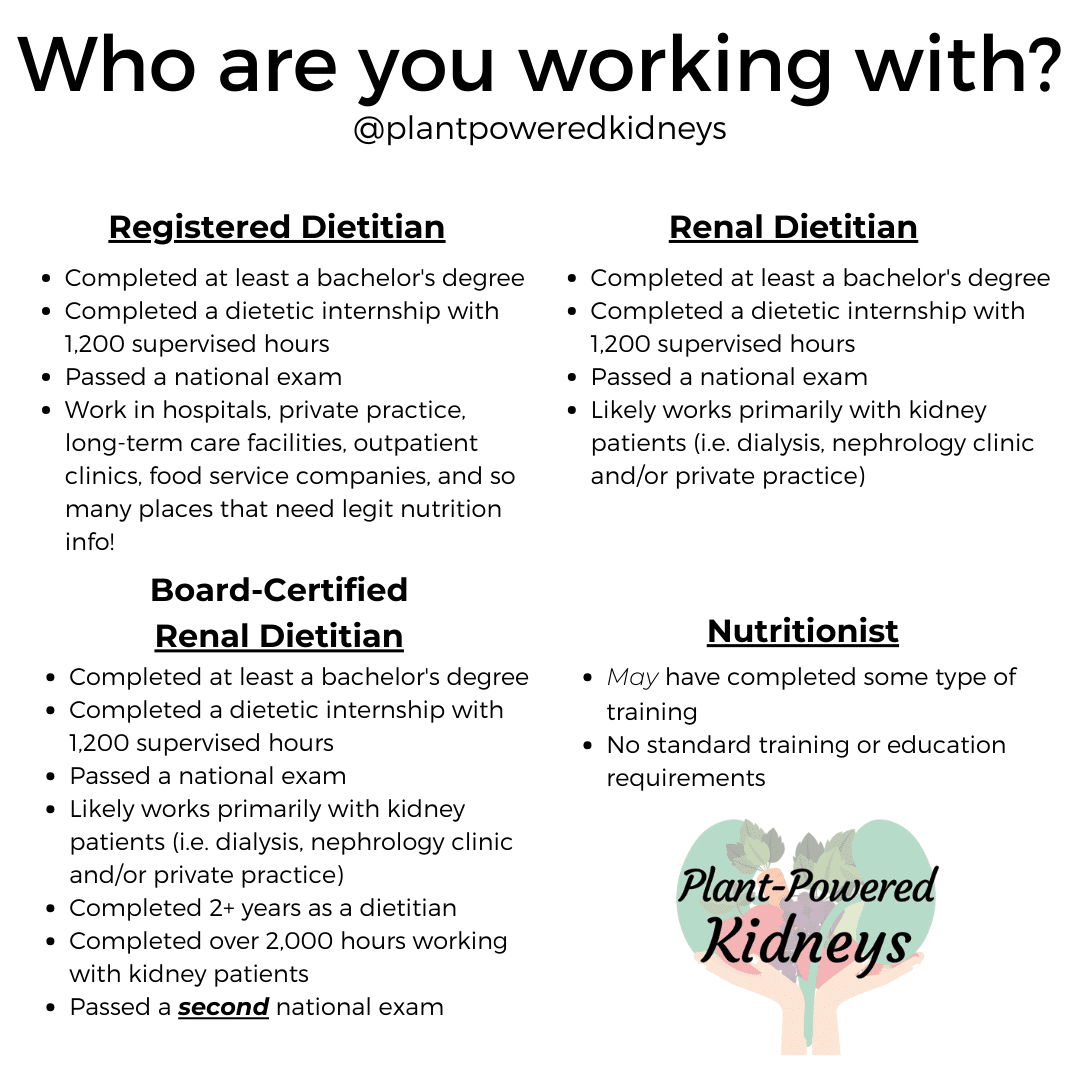

What’s the difference between a dietitian and a nutritionist?

Now that we have covered some basics about health insurance, it’s time to discuss dietitian versus nutritionist.

The two terms are very often used interchangeably. However, there is a big difference between a registered dietitian and a nutritionist.

The path to becoming a registered dietitian

A registered dietitian is a credentialed healthcare professional.

To become a registered dietitian, a person must go through college to obtain a bachelor’s degree from a U.S. regionally accredited college (or foreign equivalent).

In 2024, it will be mandatory to complete a master’s degree to qualify as a registered dietitian.

Next, the person must be accepted into a nationally recognized dietetic internship program. The internship is a highly competitive area to get into, with about a 50% admittance rate.

The internship includes 1,200 hours of supervised (most often unpaid) experience with several different nutrition fields.

Upon completion of the internship, the person will qualify to sit for the national dietitian exam.

Passing the exam then earns them the title of “registered dietitian.”

The path to becoming a nutritionist

The term nutritionist is an unregulated term. There is no board or governing body that regulates the term.

Anyone can call themselves a nutritionist. You can call yourself a nutritionist if you wanted.

(I’m not encouraging this – it’s merely to prove the point that it doesn’t hold the similar standard RD does).

There are certain licensures for nutritionists where a person can use certain credentials. You can read more about the different terms related to nutritionists here.

How can I find out if my insurance covers dietitian nutritionists?

Now that you know some of the plans and “jargon” of health insurance, as well as the differences between dietitians and nutritionist, we can ask the question, does insurance cover nutritionists?

Find out if your health insurance plan includes nutrition insurance coverage or medical nutrition therapy with the next steps.

Contact your health insurance provider

Call the 800- number on the back of your health insurance card that is for clients/customers. Follow the prompts to speak with a representative.

Be sure you write down their name. Have them spell it for you several times if needed.

For one, it will be helpful to know who you’re speaking to.

You’ll also be able to identify with whom you spoke if you need to challenge a bill.

Determine your covered nutrition services

This is the time to ask if your insurance covers nutritionists. Ask the representative, “does my insurance cover nutritionists?”

Ask if you have nutrition counseling services or nutrition insurance coverage.

As an alternative, ask about any coverage for medical nutrition therapy.

Nutrition codes to ask about

The common procedure technology (CPT) codes for services are 97802 and 97803. You can also ask if these CPT codes are covered in your plan.

The code 97802 represents an initial nutrition assessment.

You may have limits based on the calendar year or plan year as to how many times you can have an initial assessment.

What this may mean is if you see one dietitian nutritionist for an initial assessment, but decide to work with another dietitian after, they may not be able to see you for an initial assessment.

The code 97803 represents a follow-up nutrition session.

Some plans have limitations on the number of follow-ups you can have with a dietitian each plan or calendar year.

Your health insurance company may also require a referral from your primary physician for each session, or renewed referrals each year.

Be sure to ask if there are any requirements they have for you to see a dietitian nutritionist.

Find your ICD-10 codes

Your benefits may require certain diagnoses.

These will come from your International Classification of Diseases (ICD) codes and there are more than 70,000 disease codes available.

Therefore, the next thing you’ll want to do is find out if there are any specific diagnoses required by your insurance company.

You can ask about preventive nutrition, which uses ICD-10 code Z71.3.

It’s important to know that only your physician can diagnose you with these codes (with the exception of Z71.3 as it is preventive care).

You can find your personal CD-10 codes in your online health chart or by calling your doctor’s office.

Write down any ICD-10 code requirements the representative tells you.

Find out how many visits you have each year with a dietitian nutritionist.

Insurance plans run on an annual basis, including many of the covered services.

The insurance coverage to see a dietitian could be anywhere from zero to an unlimited number of sessions.

That being said, this may also hinge on the ICD-10 codes you have.

Equally important, ask when the start of the year is for benefits.

Be sure to ask what the start and end dates are for your annual plan. Benefits can reset for the “new year.”

Have I met my deductible?

Find out if you do, and how much. If you need to reach a deductible, you can request a superbill from your provider.

This is basically a receipt that you can send to your health insurance provider that will go towards your deductible. Once you meet your deductible, you may have 100% coverage.

What is my copay?

Ask about any copay required to see a registered dietitian. Health insurance covers dietitian nutritionists under specialists.

This information may be on your insurance card – check for a specialist copay.

Do I have out-of-network benefits?

If yes, you can look at dietitian nutritionists and other healthcare providers that are outside of your health insurance network.

If not, ask where you can get a list of dietitians that are in-network for you.

This is one way you may be able to work with us and have insurance help cover some of the investment.

Does my insurance cover telehealth visits?

Sometimes they will know this immediately and sometimes they won’t. You may be able to ask about location code 02 or modifier code GT or 95.

In the past years, many insurances have opened up more opportunities for people to see their healthcare providers via telehealth visits.

Medicare currently accepts telehealth as a way for you to see your providers through the year 2024.

It’s unknown how long various health insurance plans will allow telehealth visits.

Each state and insurance payer and plan will make their own decisions.

So call now and start using the benefits that you (or your employer) are paying for.

Keep yourself healthy and surround yourself with a team that wants the best for you and is willing to do what they can to get you to the goals you want to achieve.

find a dietitian nutritionist that takes your health insurance

EatRight

The Academy of Nutrition and Dietetics offers a search feature for you to look up dietitians right in your area.

Simply type in your zip code and look through the profiles that appear! Many will list the types of insurance they provide

National Kidney Foundation’s Dietitian Directory

The National Kidney Foundation has created a directory of dietitians in the United States that help people with chronic kidney disease. You’ll find us there.

The listings include insurances accepted, but be sure to reach out and verify that the information is up to date.

International Dietitian Directories

If you are outside of the United States, you may be able to find a dietitian in your country by searching your country + dietitian.

I have compiled a list of dietitian websites in different countries here.

Your health insurance company

You can use their provider directory to look up dietitians that are in your network.

On a personal note, don’t consider this the comprehensive list of dietitians available in your network. Health insurance companies may not have all of their provider’s information up-to-date.

Calling may be the best way for you to find a dietitian in your insurance network.

Ask your the dietitians you connect with

Still wondering “does insurance cover nutritionists?”

If you find a dietitian that you would like to work with, be sure to check out their website or call them up.

They’ll be able to let you know what types of insurance they take and any other available payment methods.

We do not take insurance at this time, but we do accept HSA and FSAs. Learn more about our team of dietitians here.

Summary

There are several types of health insurance including private pay, Medicare, Medicaid, Tricare, and Medicare Advantage plans. Plans will have different premiums (the price you pay for the plan), deductibles (the amount you pay first), copays (a fee for service), and coverage amounts.

Call your health insurance provider by using the customer service phone number, generally found on the back of the insurance card. Ask them if your covered services include medical nutrition therapy.

By finding out what requirements, like copays, referrals from a doctor, and certain diagnoses, you’ll find out how much insurance covers for dietitian nutritionists. They’ll also be able to tell you the number of sessions or hours per plan year you have.

Even if your insurance doesn’t cover a certain dietitian, you may be able to work with them. Health Savings Accounts or Flexible Savings Accounts can be used for many healthcare services, including dietitians.

If your dietitian doesn’t accept your insurance, you can request a superbill to submit to your health insurance provider to potentially be reimbursed. It is not always guaranteed, and they may require extra paperwork, but it may be covered.

We hope this article has helped you feel more confident in speaking with your health insurance about finding a registered dietitian nutritionist that you can work with.

Is there a way to have Medicaid insurance reimburse for renal dietician services?

Since Medicare is a state-run insurance program, it will depend on your state. Contact your state’s Medicaid office to learn more about what is covered. 🙂

You opened with the statement “Since Medicare is a state-run insurance….”

I know you meant to say “Medicaid” but you should correct the typo to prevent confusion in the future….

Hi Joseph! Thanks for letting us know. It should be corrected. 😊

Thank you so much for the information

Hello,

Do you have any resources or direction for billing mnt for pediatrics specifically for kids 6 months to age 12? I have not been able navigate this process and just wondering if you could suggestion any references?

We do not currently work within insurance networks nor see pediatric clients. The Academy of Nutrition and Dietetics insurance and billing section may be a good resource!